Primary Residential

Property Declaration

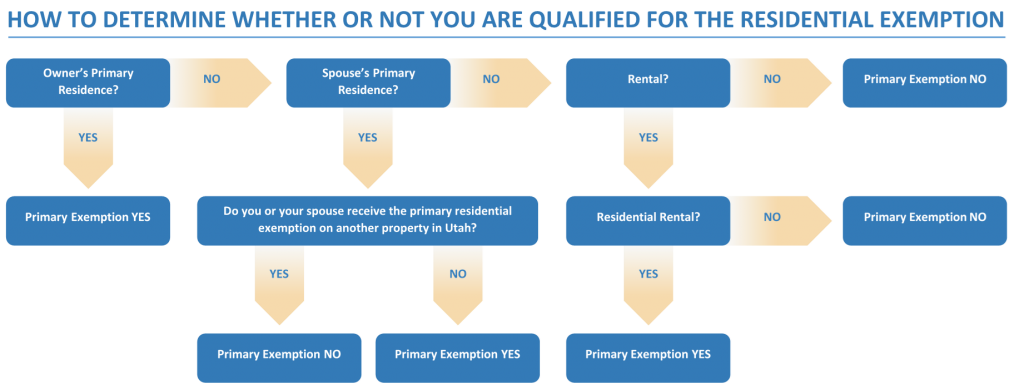

In accordance with the provisions set forth under Utah State law, the Assessor’s Office is required to verify and correctly classify all residential properties as a primary or secondary residence. State code 59-2-103 allows for a 45% residential exemption on primary residences in Utah. This means those receiving the exemption only pay property tax on 55% of the home’s fair market value.

OFFICE LOCATION

751 E 100 N Suite 1200

Price, UT 84501

Assessor

Gillan Bishop

Term 2021-2023

DEPARTMENT(S)

Greenbelt

(435) 636-3238

Business Personal Property (UPP)

(435) 636-3237

Residential Declarations

(435) 636-3247

SOCIAL MEDIA

FAQ For Residential Declaration

Primary Residential Property Declaration Application

Return to the Assessor's Office when completed.

What qualifies a home as a primary residence in utah?

Utah code defines a primary residence as a home that serves as the occupant’s primary domicile for at least 183 consecutive days in a year. The owner, the owner’s spouse, another family member, or a tenant may occupy the residence. A household may only claim one residential exemption in the State of Utah.

Please note: If a property owner or owner’s spouse claims a residential exemption for property in Utah, that is the primary residence of the property owner or the owner’s spouse, that claim of a residential exemption creates a rebuttable presumption that you are domiciled in Utah for income tax purposes. Simply, your worldwide income may be subject to Utah State income tax, unless established otherwise. This would primarily impact individuals who live out of state but claim their primary residence is in Utah. Individuals in such circumstances or believe they could be affected may wish to seek advice from an income tax professional.

WHAT IF A HOME QUALIFIES FOR THE RESIDENTIAL EXEMPTION BUT IS NOT RECEIVING IT?

If a qualifying property is not currently receiving the exemption, the owner will need to make an application with the County Assessor. When applying for the primary residential exemption, you will be required to submit one of the following documents containing the physical address of the property in question as evidence:

- Driver’s License (best option)

- Voter Registration Card

- Tax Returns

If the property in question is a rental, you will be required to submit a copy of the:

- Rental Agreement

WHO IS REQUIRED TO SIGN THE RESIDENTIAL PROPERTY DECLARATION?

All property owners must sign. This includes both spouses if the property is jointly owned by a married couple.

DEFINITIONS

A “household” means the association of individuals who live in the same dwelling, sharing its furnishings, facilities, accommodations, and expenses and includes married individuals, who are not legally separated, that have established domiciles at separate locations within the state. A household will only qualify for one residential exemption on an owner-occupied residence in Utah.

A “tenant” is a person who is not the owner, who occupies a property for at least 183 consecutive days per calendar year.